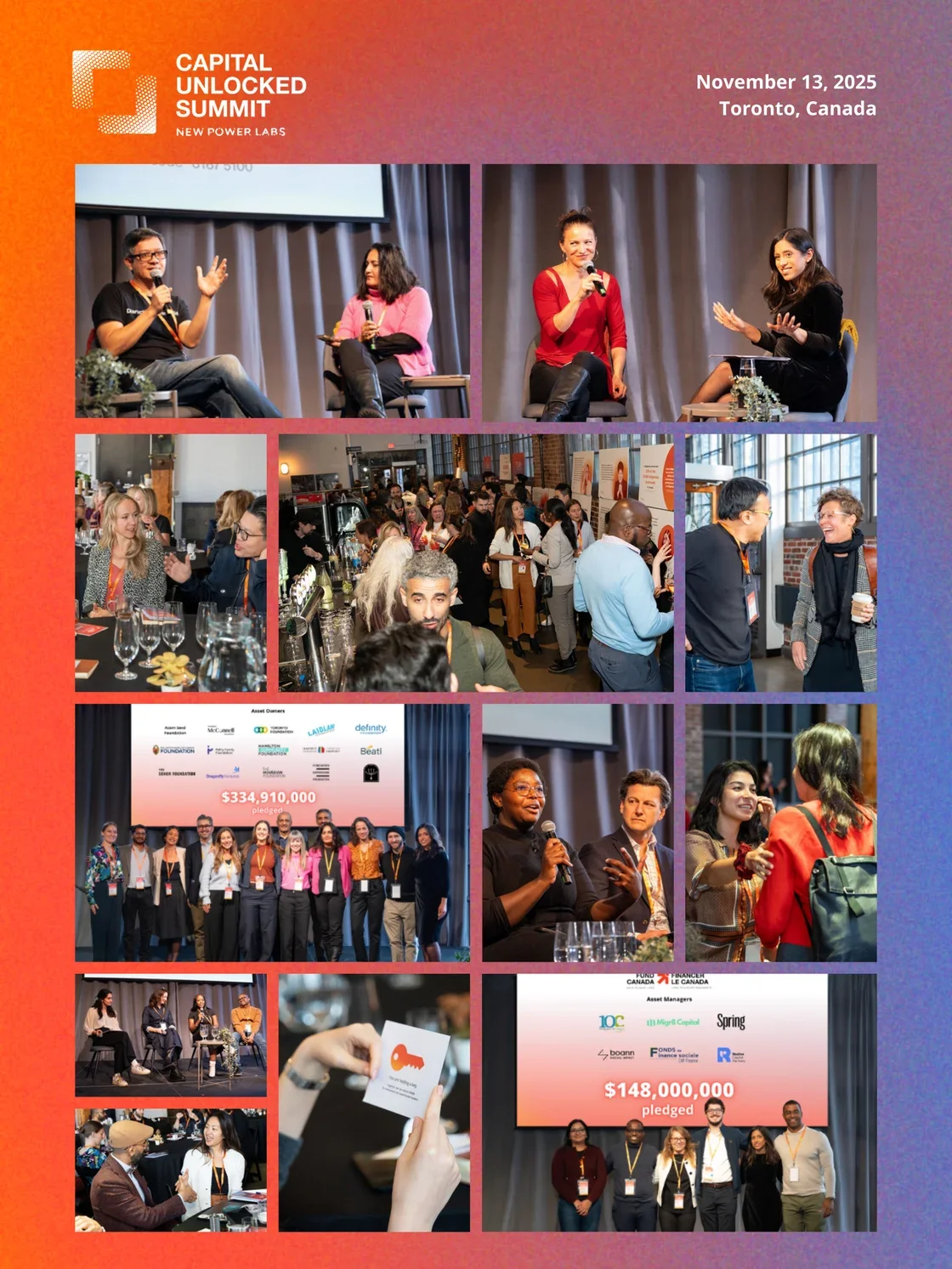

Capital Unlocked 2025 Summit Recap

2 min read · November 21, 2025

New Power Labs

Thank you for joining us at Capital Unlocked 2025! We are still buzzing from the conversations and energy in the room.

Capital Unlocked 2025 Recap

We gathered in a moment defined by turbulence – political polarization, economic uncertainty, and rising backlash against equity work. Yet throughout the day, the message was unmistakable: retreat is not an option. This is a moment for courage.

That call came into sharp focus during the fireside conversation I had with Morgan Simon (Founding Partner, Candide Group), where Morgan shared her powerful story of advocating for divestments from the private prison and immigrant-detention industry, and then being hit with a defamation lawsuit by a major private-prison operator. Yet she persisted, continuing to pressure major banks - and influencing institutional investors including Canada’s largest federal pension plan - to divest from these for-profit incarceration systems.

Her message: the cost of caution is far greater than the cost of courage, and impact requires confronting the “neutral” criteria in finance that quietly exclude women, Indigenous, Black, newcomer, and diverse fund managers. Courage, she reminded us, does not only manifest in heroic leaps; it is also the next best step we take, again and again, with intention.

The conversation between Vu Le (Writer, NonprofitAF) and Sadia Zaman (CEO, Inspirit Foundation) pushed us further. They named the cultural patterns holding our sector back: a philanthropy addicted to overthinking; data used as a barrier instead of a tool; and a deep structural problem of moderation where comfort, politeness, and tone are prioritized over justice. Vu and Sadia challenged us to think in decades, not cycles; to fund movements, not moments; and to recognize that the backlash we feel is a reaction to real progress and a sign that we must double down, not back away.

This collective challenge to think long-term and stay the course naturally set the stage for the day’s most important milestone: the launch of Fund Canada. Fund Canada is a national, multi-year initiative to unlock capital for underfunded and overlooked leaders across the country.

With $334.9M committed by 16 asset owners and $148M by 6 asset managers at launch, Fund Canada represents philanthropic and financial sectors’ commitment to back the breadth of talent and innovation driving Canada’s growth. And this is only the beginning.

Learn more and join the movement at https://www.newpowerlabs.org/fund-canada.

Throughout the day, the shared message from speakers across sessions reinforced a shared message for us to aim higher, start now, and move money through concrete next steps.

In the Future of Capital discussion, Dr. Caroline Shenaz Hossein (Canada Research Chair, University of Toronto), Smitha Das (Senior Director, Investments, World Education Services), Andrea Clarke (Executive Director, Fondation Dents-de-Lion), Jon Shell (Chair, Social Capital Partners), Kristen Richard (Manager of Sinew Impact Fund, EntrepreNorth), and Dr. Shilpa Tiwari (Senior Advisor, New Power Labs) showed how shifting power, redefining risk, and investing in solidarity economies can restructure capital flows for the long term. We can move practical reforms forward today while re-imagining and shaping the systems that will define tomorrow.

Through lightning talks, Jason Sukhram (Director & Impact Services Lead, Quinn+Partners) and Kevin Thomas (CEO, SHARE), Omar Yaqub (Executive Director, Islamic Family Foundation), Jon McPhedran Waitzer (National Organizer, Resource Movement), Paula Sahyoun (Manager of Systems Change and Social Finance, SVX and Founding Member, Palestine Impact Collective), and former Senator, the Honourable Ratna Omidvar with Bruce MacDonald (CEO, Imagine Canada) demonstrated the tools that turn values into leverage and leverage into outcomes: shareholder action, halal finance, movement-led philanthropy, divestment, and data policy.

Our workshops brought participants into practice: Vu Le on challenging philanthropy’s status quo, Allison Gibson (Senior Advisor, New Power Labs) on debugging gender bias in investment decisions, and Kuru Masomere (Director of Capital Strategies, Justice Funders), Jon McPhedran Waitzer, and Jerry Koh (Impact Lead, New Power Labs) on exploring the Just Transition Capital Framework. Contribute to the Just Transition Investment Framework for Canada mapping here and sign up to stay connected with this initiative.

In the Closing Plenary, Sara Krynitzki (Associate CEO, Philanthropic Foundations Canada), Kuru Masomere, Dipo Alli (Partner, Migr8 Capital), and Merette Mathieu (Partnerships Director, New Power Labs) reminded us that sustaining this movement requires shared responsibility and the willingness to move money differently and boldly.

Across every conversation, a narrative emerged: we know what works. The leaders closest to the issues have the solutions. What’s missing is the flow of capital and the courage to sustain it.

This is why Fund Canada matters, and why we are inviting partners across the country to join the movement.

A special thank you to:

Our Major Sponsor, World Education Services – without whom this Summit would not have been a success. Check out our report with WES on removing barriers to credit access for immigrants in Canada, released earlier this year here.

Sponsors Genus Capital Management, Clear Skies Investments Management, Lawson Foundation, and Rhia Ventures; activation partners Dents-de-Lion Foundation, Boann Social Impact, and ISED; and strategic partners Philanthropic Foundations Canada and Imagine Canada.

And thank you to each of you: funders, investors, asset managers, community leaders, founders, and entrepreneurs, for choosing boldness over caution.

As Stephanie Tsui from Genus Capital Management noted “...the capital decisions we make today shape the future we all share.”

It is more important than ever to open our apertures and widen our funnels to diverse-led enterprises and impact organizations that are building a stronger and more resilient Canada.

Let’s keep building this together.

Narinder

New Power Labs

Like what you’re reading? Subscribe to get weekly Equity Shots in your inbox.