A weekly shot delivered to your inbox, with a brief, thought-provoking perspective related to equity, power, and access to capital.

Read past Equity Shots.

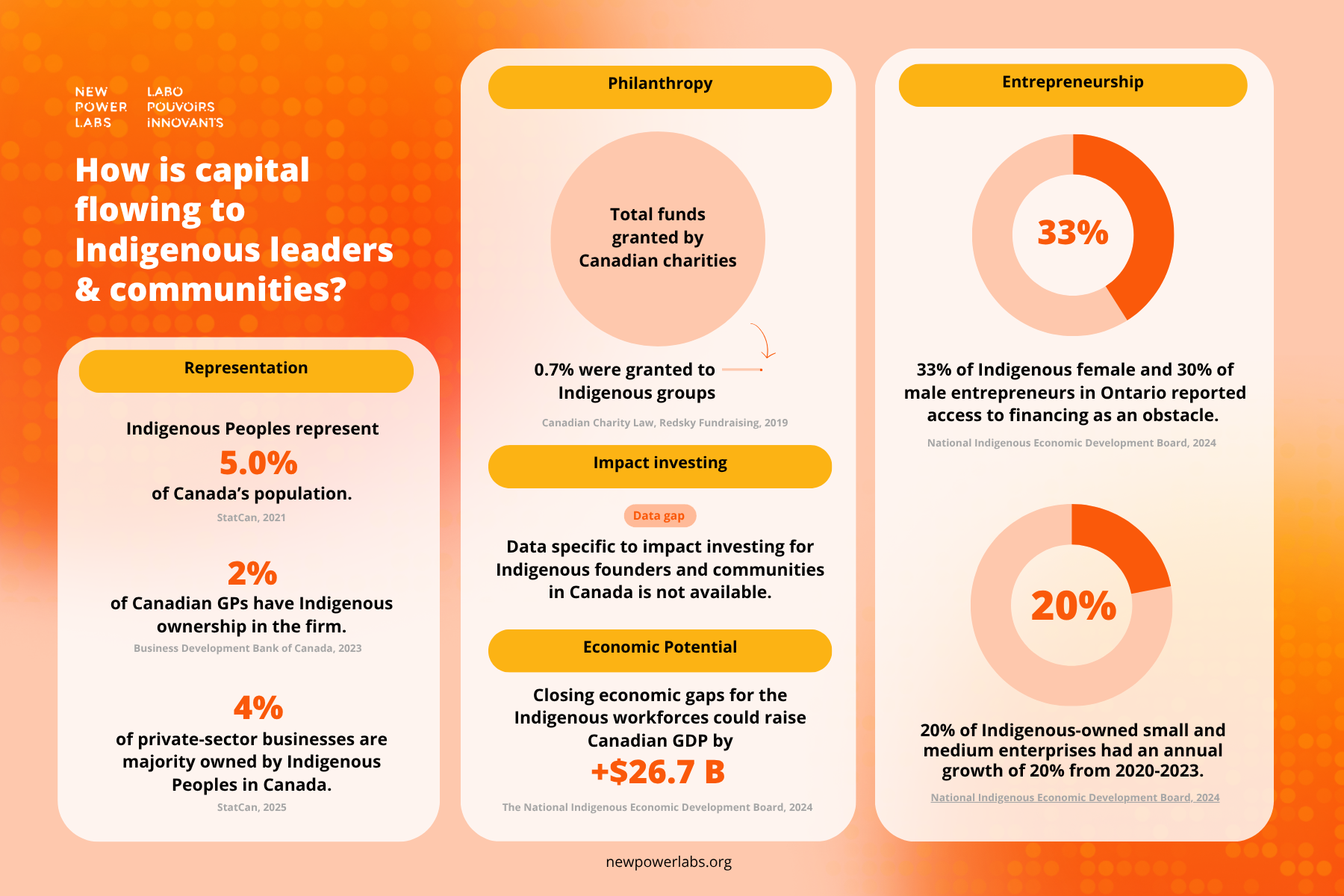

Many Canadian firms are still expanding the circle of those who gets to shape investment decisions.

Many Canadian firms are still expanding the circle of those who gets to shape investment decisions.

Our sector’s tendency to fund narrowly and briefly puts us at a disadvantage against movements that are playing the long game.

When money keeps circulating among the same players, we mistake concentration for strength.

Until we break the habit of funding the comfortable version of equity, we will never fund the courageous kind.

“Behind every social challenge is the nefarious hand of money causing pain, but also, the opportunity to subvert the harms of capitalism by investing in real solutions.”

Without the ability to use land and properties as leverage, a fundamental tool for wealth creation is inaccessible.

Moving from “elbows up to arms linked” may be exactly what this moment demands.

We celebrate when women achieve better representation in organizations, but what if that success creates a new barrier?

Reimagining financial access means ensuring that services remain physically available and are designed to serve all in Canada.

Without better data, Canada’s philanthropic and impact investment landscape is unmapped, and what appears to be progress may be little more than perception.

Commute time was the single strongest predictor of upward mobility among low-income families, even stronger than crime rates or school quality.

Canada needs more businesses, and more of them to thrive. Elevating immigrant entrepreneurship is one way to get there.

If accelerators want to live up to their “impact” label, they need to confront inequity head-on.

Women perceived as 2SLGBTQIA+ were 30% less likely to advance to the interview stage.

Once we attach our identity to an idea or a stance, it is harder to let go.

A 2022 study by Lyonnet and Stern found that a machine learning algorithm can outperform traditional VC decision-making.

Diversity isn’t what happens after we find excellence; it’s how we get there.

2SLGBTQIA+ leaders are already building businesses, jobs, and innovation. The only question is whether capital and funding systems will catch up or continue to overlook this vibrant, growing force in Canada’s economy.

Indigenous-owned businesses contributed $48.9 billion to the Canadian economy annually.